M&A Buy-side Tecquisition

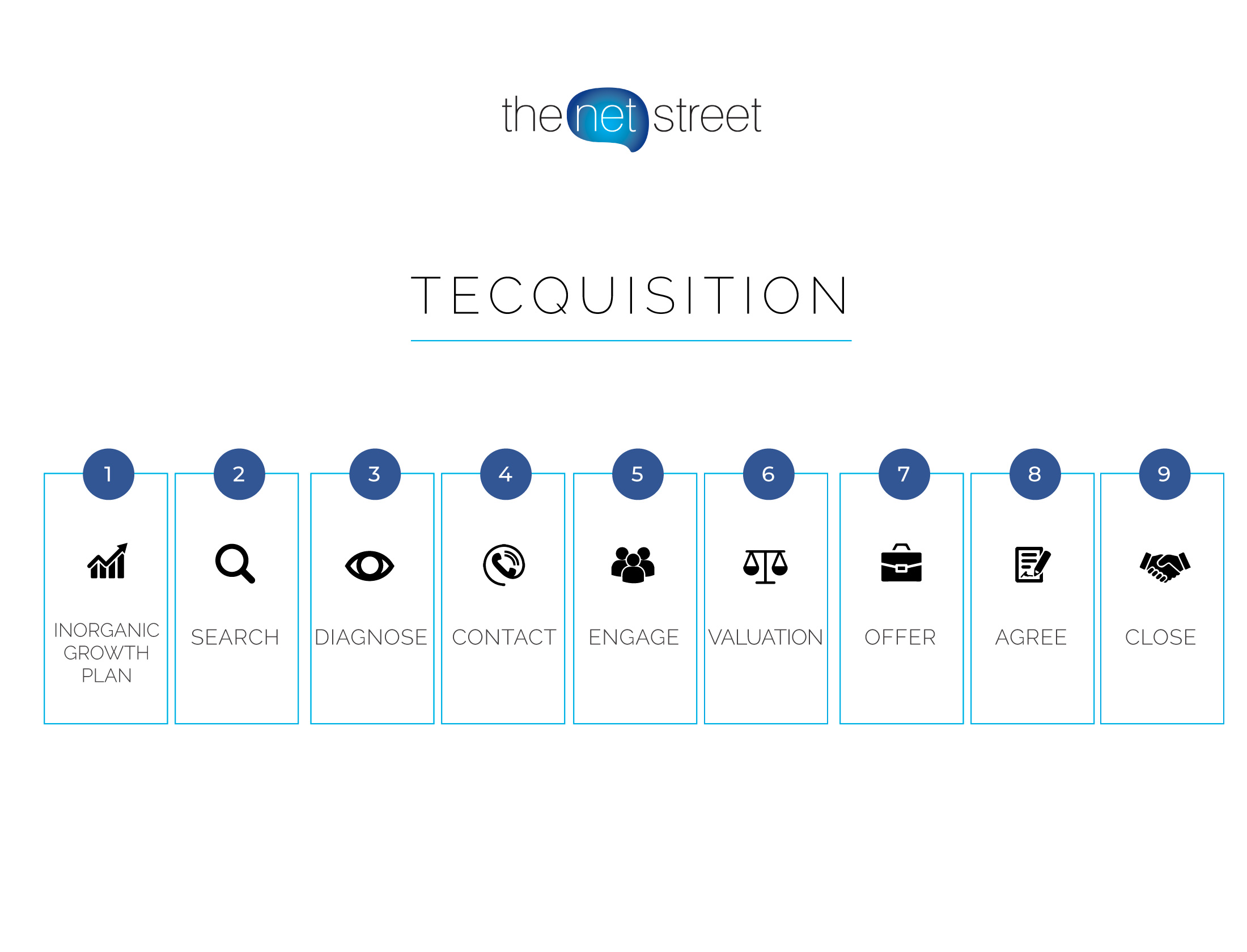

We have evolved Corporate Venturing transforming established companies through startup driven innovation. We use our own M&A Buy-Side approach: Tecquisition.

Historically, companies have acquired or merged with others in order to drive synergies or market share. Targets have been similar to the acquirer. As the rate of technological change increases, however, disruption risk is affecting corporates everywhere. The need to defend a market position by acquiring tech capabilities or talent is one of the pervasive drivers of M&A in Europe, and elsewhere. We identify acquisition targets, provide valuation assessment, and evaluate options involved in the acquisition.

We help these companies create more value, guard against disruption and enhance the customer experience by acquiring the right tech company.

- If the startup is acquired for its IP, talent or revenue, it should be rapidly integrated into the acquirer

- If the startup is acquired for its products and/or users, preserve its startup culture by keeping it an independent unit

- We create a formal integration, an on-boarding process and incentive programs need to tie together the new acquisition’s continued success and the rest of the company

We are involved throughout the negotiation process, carrying on due diligence, and validating the deal by providing legal advice.

We apply our high tech business experience to deploy innovative strategies, invest or help to fundraise and connect corporations with the start-up ecosystem deploying through our M&A Boutique corporate venturing strategies. Our knowledge and expertise in tech business set us apart from the rest.